Taxes applied to a purchase

Billing address in Switzerland and Lichtenstein

The statutory value added tax (VAT) of 8.1% is applied to all invoices.

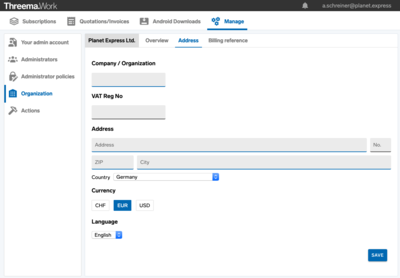

Billing address in the European Union

In accordance with EU law, the invoice does not include VAT if you register your legal entity’s VAT Reg No in the admin account or provide it afterward:

In this case, the reverse-charge regulation applies and the tax liability transfers to the recipient of services.

If the VAT Reg No is not stored in the profile, the country-specific VAT must be billed in addition to the purchase amount.

Billing address in other countries

Depending on the local law, the recipient of the service is liable to pay the VAT and, if applicable, declare the import of the service to the relevant tax authority. Please consult your local tax authority for binding information.